Figuring out how to pay for mental health services is stressful! Whether you will be using insurance or paying out of pocket (aka “private pay therapy”), paying for mental health treatment can be pretty confusing to figure out.

Most people would like to use their insurance benefits if they can – if this is you, it’s important you know how to understand your coverage to figure out costs. Also, be aware that mental health coverage varies by plan, so you and your neighbor may both have Cigna insurance but have vastly different mental health coverage.

By law, insurers are *supposed* to offer parity for mental health coverage. This simply means that insurance coverage for mental health conditions should be equal to coverage for any other medical conditions. Unfortunately, this is difficult to enforce. Loopholes also exist, resulting in many plans still allowing different benefits for mental health – including potentially no mental health coverage!

As far as what falls under behavioral health, generally this includes treatment for mental illness and treatment for substance use. However, I have seen some plans where psychiatric care falls under “medical,” while psychotherapy is considered “behavioral health.” This can make figuring out what your plan covers a bit easier when looking for a psychiatrist, but sometimes even more confusing if searching for a therapist, in-patient services, or long-term treatment programs. This post will walk through you everything you need to know to understand how to pay for mental health services regardless of where you go or who you see.

Understanding Mental Health Coverage with Insurance

There are several key terms that are essential to know in order to understand the mental health coverage included with your plan:

In-network (HMO, EPO) – in-network health care providers have contracted with your insurance company to accept certain negotiated (i.e. discounted) rates. They bill your insurance directly and you are responsible for paying either your co-pay, or the full contracted rate until you meet your deductible, depending on your plan. If you have an HMO or EPO plan, your insurance only covers in-network providers.

Out-of-network (PPO, Choice) – out-of-network providers do not have a contract with your insurance company and you will have to pay the provider their full fee. If you have a PPO or Choice plan, this means you have out-of-network coverage. This almost always involves having an OON deductible, so you have to pay the full fee on all OON medical services until you reach the deductible, and then at that point your insurance will reimburse you a certain percentage of the amount you paid (see coinsurance below).

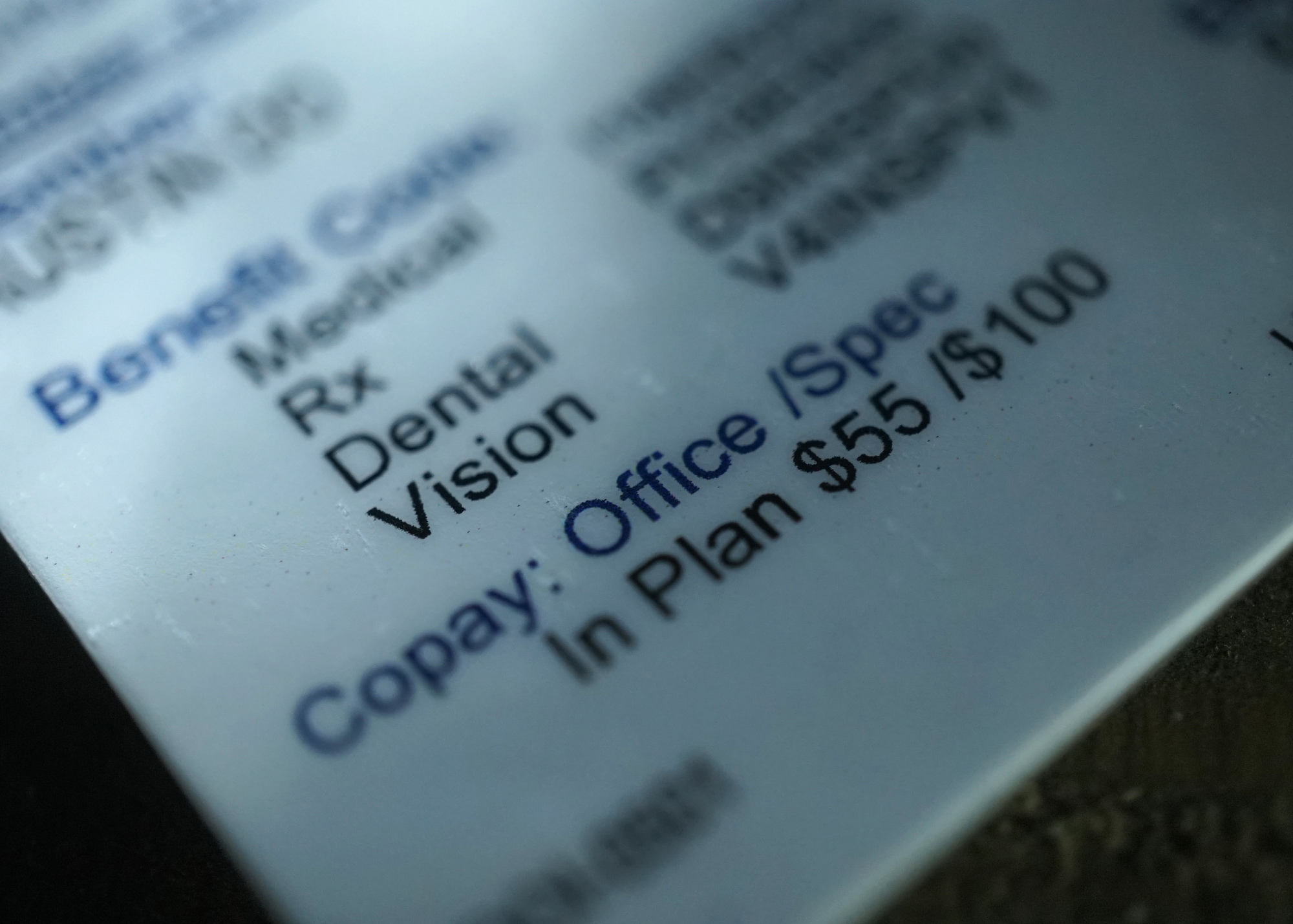

Copay – this is a fixed amount you are required to pay for in-network services, i.e. $10 or $50.

Deductible – this is the amount you owe for covered health care services before your insurance plan begins to pay. You have to pay the full contracted rate for all in-network services until you meet your deductible. Deductible plans usually then have a coinsurance you are responsible for rather than a copay. If you have OON coverage, you will have separate deductibles for INN and OON.

Coinsurance – this is an amount you may have to pay that is set as a percentage, whether this is for in-network or out-of-network services, such as 20% or 50%. If you have OON coverage, your coinsurance may be a different percentage for INN and OON.

Out of Pocket Maximum – this is the most you would have to pay for covered services in a year. If you reach this amount, in-network or out-of network, your insurance pays the full cost of covered services for the remainder of the year.

HSA/FSA Account – a Health Savings Account or Flexible Spending account. You and/or your employer contribute pre-tax dollars, and you can use these funds to pay for eligible medical expenses, including copayments or coinsurance for covered services and for eligible medical services not covered by your plan.

Superbill – a specialized receipt/invoice that an OON provider may give you after you have paid for their services so that you can submit it to your insurance to receive reimbursement according to your OON benefits .

Courtesy Billing – this is not required, but is offered by some OON providers. After you have paid for your services in full, the provider may offer to file a claim on your behalf with your insurance for them to reimburse you, rather than giving you the Superbill to submit to your insurance on your own.

EAP – an Employee Assistance Program is offered as a benefit by some employers that provides free mental health assessments and short-term counseling, so you are able to receive a certain number of sessions for free. Warning: your EAP benefits may be provided through a different insurer than your primary health insurance. For example, you may have Aetna insurance, but your EAP is through Optum (United Healthcare). If you find a therapist that accepts your EAP benefits, but is not in-network with your regular insurance, you will have to find a new therapist after just a few sessions or continue meeting with them but pay their full fee.

Carveout – behavioral health carve out plans are when an insurance plan subcontracts a set of benefits to another plan or network (usually a less common insurer). Employer provided plans often do this to reduce costs. Mental health coverage is a common set of benefits to be carved out. For example, Anthem Blue Cross plans may carve out mental health to Magellan or Beacon, so even if you find a therapist in-network with Anthem BCBS, they might not be in-network with Magellan, so you have to check.

Office versus Telehealth visit – some plans have different benefits depending if you are receiving services in-person (an “office visit”) or virtually (a “telehealth visit”). Sometimes, this makes receiving mental health services easier. For example, I’ve seen plans that cover therapy at a $0 copay when provided via Telehealth. Other times, it unfortunately makes it harder. For example, some plans carve out their telehealth benefits to a specific virtual platform, such as MDLive or Teladoc. I’ve seen this just for mental health but also for all virtual medical services, meaning even if your PCP or your therapist is in-network with your Cigna insurance, you cannot meet with them virtually unless they are also contracted with MDLive. Unfortunately, many providers are not in-network with these virtual platforms.

Private Pay Therapy – this refers to when someone who potentially has insurance, pays for services privately with their own funds rather than having the service billed to or reimbursed by insurance. If a therapist or psychiatrist lists themselves as “private pay” – it means they do not work with insurance. Sometimes this means they have no in-network contracts, for others it means they will not provide Superbills and you agree not to submit services for reimbursement. This is because when you submit services for reimbursement, even though the provider is OON, the insurance can still dictate when/how/why services are provided to consider them “covered” and eligible to be reimbursed. Private pay therapy can be paid with HSA/FSA cards as long as it is an eligible medical expense according to the IRS. Psychiatric care, psychotherapy and counseling are all eligible if provided by a licensed clinician.

Sliding Fee – providers may offer a sliding scale (whether or not they accept insurance) so that clients in financial need are responsible for paying a lower fee according to their income

I know that was a lot, but hopefully that helped the details of your plan to make a little more sense!

How to Get Mental Health Treatment Without Insurance

What if you won’t be using insurance? Some people might not have insurance, or there are a variety of reasons someone might not want to use insurance. For example, the most common are privacy concerns, having a high deductible plan, or wanting freedom from insurance’s policies about what they will and will not cover (such as wanting to meet for longer sessions or more frequently). In these cases, you always have the option to see a private pay therapist. If you cannot afford private pay therapy, here are a few alternative options:

- Clinicians-in-Training

If you are willing to work with an intern, they offer reduced fees. Interns often work at group therapy practices or you can check if local colleges/universities have an on-site counseling center.

- Sliding fee spots/cash pay discounts

Some therapists offer a sliding fee scale (defined above). Some psychiatrists will offer discounted rates if paying cash. You will want to do a specific search for these providers in your area. Google your city (or state if you are open to telehealth) plus “low fee” or “sliding fee” therapy and/or “discounted cash rates” for psychiatry. You can also ask providers you’ve already found in your search if they offer this.

- Federally-funded or other community mental health clinics

These are available to anyone in need of psychiatric care even without insurance. You can search for clinics in your area here

This is a nationwide directory of mental health professionals who charge $40-$80/session. Unlike more extensive mental health directories, this website only includes sliding scale therapists in the searchable database.

How do I know if my insurance covers mental health?

Ultimately, the only way to know for sure what your benefits are and what your plan does and doesn’t cover is to make a phone call. Gross, I know. So check the back of your insurance card, and there should be a number for “Member Services.” Some cards might list a separate number for “Behavioral Health” – call that one if you see it listed.

Here is a list of questions you can use when you call to verify your mental health coverage:

What are my mental health benefits?

– In-network?

– Out-of-network?

Do I need a referral or prior authorization for mental health services to be covered?

How much is my co-pay/co-insurance for mental health services?

– In-network?

– Out-of-network?

Do I have a deductible to meet for mental health services? If yes, how much is it and how much of it have I met?

– In-network?

– Out-of-network?

After I have met my deductible, what is my percentage of responsibility?

– In-network?

– Out-of-network?

What is my yearly out-of-pocket maximum?

– In-network?

– Out-of-network?

You may also wish to verify coverage for one or more specific CPT codes. So ask: Are the following services covered? Are they covered the same if provided as an office visit or via telehealth? Are there any limits to how many sessions will be covered within a year?

90791: Psychiatric diagnostic evaluation

90834: Psychotherapy, 45 minutes (38-52 minutes)

90837: Psychotherapy, 60 minutes (53+ minutes)

90846: Family psychotherapy, without patient present

90847: Family psychotherapy, with patient present

90853: Group psychotherapy

If you are considering working with an OON provider, you may want to ask these additional questions:

– What is the Usual and Customary Rate? (This is the maximum amount the insurance will base their reimbursement off of – for example, if you have 50% coinsurance for OON, and the UCR is $150, then if your therapist charges $200, your insurance will still only reimburse you $75).

– How do I submit claims for reimbursement? How often can I/should I submit claims?

– How do you send me my reimbursement?

I hope this has been helpful for you if you have been struggling to navigate how to pay for therapy or other mental health services!

If you are looking for a trauma therapist in Denver (or online for anyone living in Colorado or Georgia), you can learn more about my therapy practice here.

Leave a Reply

Contact

THANK YOU!

We received your information and we will be in touch soon. Please allow 48 hours response time.